With its durability,...

Factors affecting the price increase of metal boxes

With the reopening of economies around the world, the prices of some commodities have soared, including the prices of metal boxes for major foods and medicines. The extent of the rebound in metal box prices will depend on how multiple factors will work.

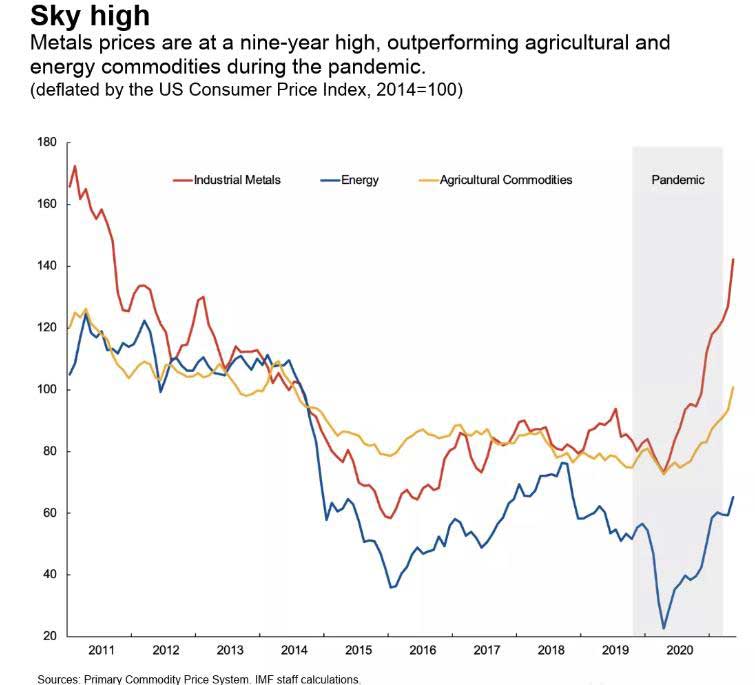

As shown in the latest IMF chart below, the price of metal boxes has risen by 72% compared to before the new crown virus pandemic, and reached a 9-year high in May this year (calculated on an inflation-adjusted basis). Metal box prices have risen widely. Iron ore prices rose 116% in May. Therefore, the price of metal box containers for most commodities is also rising, which is a few percentage points higher than the price before the new coronavirus pandemic.

Why is the price of metal boxes rising more than other commodities? The reasons are as follows:

01. Recovery based on manufacturing

At the beginning of the new crown virus pandemic, manufacturing activities did not decline significantly, and the recovery rate was faster than that of the service industry, especially in China, which is a major user of metal raw materials. At the same time, industries dominated by energy commodities, such as the transportation industry, are still in a downturn. For example, global road fuel consumption is only 93% of what it was before the COVID-19 pandemic, inhibiting a further rebound in oil prices.

02. Supply-side factors

Many mining operations were temporarily suspended due to the new coronavirus. In addition, due to congestion in key ports, quarantine restrictions, and crewing issues continue to exist, the freight rate for bulk material transportation has reached the highest level in a decade. In the spring of 2020, fuel prices rebounded from the deep valley, all of which increased the cost of raw materials for metal boxes. Therefore, the price of metal boxes has been rising since May.

03. Expectations for accelerating energy transition and infrastructure spending

Optimistic expectations for the pace of transition to a green economy and ambitious infrastructure projects have further boosted the price of raw materials for metal boxes. Both will increase the "metal strength" of the global economy. For example, the International Energy Agency (IEA) stated that to achieve a rapid energy transition, the consumption of lithium in electric vehicles and renewable energy may need to increase by 40 times, and the consumption of graphite, cobalt and nickel for these purposes may increase. About 20 to 25 times. Ambitious infrastructure projects in the European Union and the United States will drive up demand for copper, iron ore and other industrial metals.

04. Storage of metals

Metals are easier to store than crude oil or some agricultural products that require special equipment. This makes the pricing of metals more forward-looking. Therefore, the price of metals is more sensitive to changes in interest rates (lower interest rates reduce the "carrying cost", which also includes storage, insurance and other Expenses, etc.) and market expectations are more sensitive, such as the issue of accelerating energy transition and infrastructure spending.

Will metal box prices continue to rise or fall? This is a challenging question.

Market participants seem to expect metal box prices to peak soon, because the impact of factors 1 and 2 on metal box prices is considered temporary. In fact, the futures market indicates that the price of metal boxes will increase by 50% in 2021 (year-on-year), but will fall by 4% in 2022.

Nevertheless, it is expected that the price of metal boxes will remain high and may rise further because the price of iron ore continues to rise. But on the other hand, if the energy transition and infrastructure planning legislation is not approved or the government actions do not implement the plan as expected, resulting in a drop in iron ore prices, the price of metal boxes will also drop significantly.

.jpg)

.jpg)

.jpg)

Latest comments